Written by Shu Pan, AI-Product Manager

What is a bank statement?

A bank statement is an official file issued by the bank that records a specific account holder's bank account information, summarising key transaction information from the account during a set period of time. In the current Indian market, there is a broad consensus that a bank statement is the best source for profiling an individual or a company's financial condition due to the following characteristics:

-

Accessibility:

According to the Reserve Bank of India, 80 per cent of Indian adults had a bank account in 2017. Therefore, the bank statement is naturally and widely accepted as the best source of information.

-

Comprehensiveness:

A bank statement provides more comprehensive information for measuring the overall financial status of an individual than other financial documents such as a credit card bill (recording spending patterns) and pay slips (direct proof of income).

-

Reliability:

Some document, like pay slips, are usually customised by the provider (employer), which makes it quite difficult to check the validity. In comparison, bank statements offered by banks are relatively easier to validate.

What information can we get from Bank Statement Analyser?

Through the analysis of a bank statement, specifically by categorisation (e.g. computing the total loan amount) and statistical analysis (e.g. minimum monthly balance, average credit card payment), we can potentially answer questions like:

-

How much money does the account holder make every month?

-

How much debt does the account holder have?

-

Does the account holder have insurance?

-

What kind of consumer is the account holder? Does he/she often spend ahead?

Why do we need an intelligent Bank Statement Analyser?

Analysing a bank statement is helpful to obtain financial status. Can we efficiently analyse it all through manual calculations? The answer is no due to the following reasons:

-

Different standards across banks:

Different banks usually have a different document format for their bank statements, and they use different codes and wording in describing their transactions.

-

Expertise required:

Mining valuable financial status information usually requires professional financial knowledge to categorise the transactions based on the description.

-

Time-consuming:

Analysing a bank statement is very tedious and daunting because a bank statement usually contains a very large amount of data. For example, a bank statement that contains 6 months of transaction recording can be up to 10 pages.

What differentiates ADVANCE.AI's Bank Statement Analyser?

-

High accuracy:

Our data recognition and extraction model achieve an accuracy rate of 99.5%, utilising a combination of heuristics and machine learning technology. The categorisation model, which deploys deep learning technology, also provides first-tier accuracy and performance.

-

Wide coverage:

The model provides coverage of more than 200 banks (including different templates from each bank) in India, which includes 99.9% of the market.

Case Study

A bank statement's analysis results can be utilised in various scenarios wherever there is a need for financial status information, such as personal loan applications, credit card applications, and SME project financing. According to TechSci Research, personal loan applications are expected to grow at a formidable rate of around 10% from 2020 to 2025 – ADVANNCE.AI’s Bank Statement Analyser can help automate the process.

The following is a case study that was completed with one of ADVANCE.AI's clients, using dummy data in the personal loan application scenario:

A loan applicant submitted his 6-month bank statement from HDFC; we will highlight some of the insights gained from ADVANCE.AI Bank Statement Analyser results:

-

Salary:

Through the following entries, the model has recognised the salary correctly (with validation on the consistency of date and amount for different months) which proves the applicant's income level and employment status:

Output category: Loan Repayment

-

Existing loans:

-

The model has recognised repayment of existing loans by recognising the "Rhino Finance "loan company, which shows that even though the applicant has existing loans with an average monthly payment of 5k Rupees, he did manage to make regulatory payments.

Output category: Loan Repayment

-

Similarly, the model has recognised another loan repayment from "KrazyBee".

Output category: Loan Repayment

-

-

Cash deposits:

Cash deposit has been recognised with an alert generated by the Anti-Fraud function because the amount is higher than the salary.

Output category: Cash Deposit - Higher than salary as suspicious action alert.

-

Risk Rule Engine:

Some lending firms have a risk rule engine in which the following rules will help in the determination of loan decisions:

-

Stable income - Good

-

Income amount not very high - Bad

-

Multiple loans from different platforms - Bad

-

Regular repayment of loans - Good

-

Suspicious deposit larger than salary - Bad / Needs verification

-

-

Credit Risk Modelling

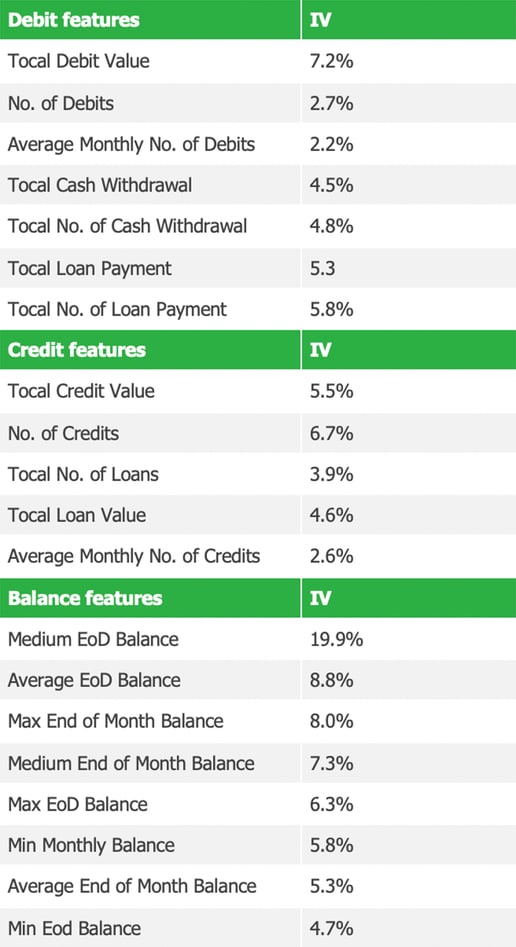

Some lending firms use a credit risk model, and the complete outputs of the Bank Statement Analyser can provide valuable inputs for the model. The following are some of the high IV parameters selected by a lending firm using post loan performance.

The bank statement is easily accessible and widely used in India. It has been generally recognised and accepted as the best financial status analysis information source. Get a free trial of the ADVANCE Bank Statement Analyser by contacting us at: sales@advance.ai