Written by Rahmi Pramesti, Senior Product Manager, and Andre Dana, Data Analyst

Harnessing Alternative Data and Advanced Analytics

Many organisations have struggled to keep pace with the demand for digitization across industries. Meanwhile, consumers accelerated their adoption of digital channels for daily transactions amid the COVID-19 pandemic, which also increases the competition amongst organisations across sectors.

However, the adoption of new-gen technologies for digitalisation in the financial service industry does not obtain balanced development long before the pandemic outbreak – For example, Indonesia financial service market started to introduce financial technology (fintech) in 2014, and with fintech’s extremely active innovation, the bar of technology and advanced analytics adoption in the financial service industry has been raised. As a result, the “early-bird” financial institutions, which has seized the market opportunities, tackled the challenges of digitalisation and benefited from the financial technology adoption, but many financial institutions are still behind the curve.

Meanwhile, those one-step-ahead financial institutions, which have shifted their core research and development fields from intensive consumers technology to advanced analytics technology, becomes new-gen financial providers that can provide real-time and customer-centric services.

As advanced analytics technology plays an increasing part in creating value for financial institutions and their customers, financial institutions need to reinvent themselves as the data-forward institutions, so they can deliver real-time, customised and personalised products or solutions more widely – at present, most mainstream financial institutions are aware of the imperative for this action and have embarked on the necessary transformation to be the data-forward institutions.

However, most financial institutions are still at the beginning of their transformation journey. They face lots of challenges from data quality, data availability, as well as from talent resource. Although they have had data quality-related initiatives in place of their agenda for the past decade, increasing other regulatory requirements such as policy, governance, models, aggregation, metrics, reporting, and monitoring has put more pressure on them and changes the focus of their transformation journey. In addition, the low literacy rate in Indonesia (only 36% of the Indonesian population have the literate ability) poses another challenge for financial institutions to promote the services into the market.

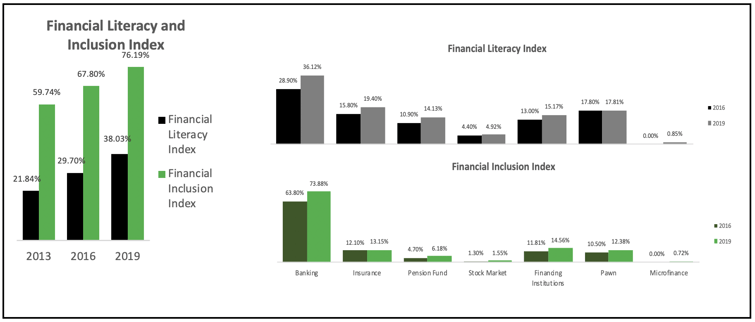

Figure source: OJK, National Financial Literacy and Inclusion Survey 2019

Thus, financial institutions that can provide services to more wide-coverage customers via orchestrating data, talent, methods, and technology while maintaining a “data-first” vision and delivering “data creating value” propositions will take advantages of the market of the future.

To help financial institutions leapfrog competitions and tapping into strengths of future development, four capability layers that financial institutions need to build: engagement layer, enactment layer, technology layer and operation layer.

- Data engagement capability

Most financial institutions have made great strides in collecting and utilising data from their daily operations. So far, just a few financial institutions can link internal data with third-party data or other public data sources and make full usage.

In addition, the significant gap of data statistics between the financial inclusion index and literacy index might imply that most people may not be able to understand well about financial products, it will affect the minimum financial information gathering that the financial institution will need to use for future financing scheme and risk analysis.

Therefore, if the financial institutions overlook the usage of external data (also known as alternative data), they will miss the opportunity of taking the lead in the market of the future. Thus, staying abreast of the expanding alternative-data ecosystem and integrating the broad spectrum of alternative data into their own business processes will be the competitive advantages for financial institutions to outperform their competitors.

Alternative data can deliver more value and insights that cannot be provided by financial institutions’ internal data solely, for example:

-

Assistant in strategic initiatives

-

Help identify ideal segment prospect by analysing potential financing opportunity across e-commerce platform.

-

Help identify new product development and improvement opportunity by leveraging telecommunication data, other behaviour data such as the spending behaviour in e-commerce, loan behaviour in other financial institutions.

-

Help expand the customer base to unserved and underserved segment by leveraging data from other digital activities such as telecommunication and utility services.

-

-

Assistant in risk management

-

Help minimise fraud risk based on nearly real-time analysis from social media, telecom providers, or other financial institutions.

-

Help optimise risk profile at the enterprise level by infusing alternative data into internal data-based risk assessment.

-

-

- Enactment capability

It is crucial for financial institutions to inject alternative data into tailored services and transforming it into insights to address customer’s needs and simultaneously enforce prudential banking practices.

- Technology capability

To achieve outstanding performance, financial institutions need to reshape two major components: service creation and talents. As financial institutions have engaged with alternative data, they will be able to create solutions to serve a wider customer base and enhance assessment mechanism, which results in lower risk exposure.

Given the breadth and depth of alternative data, financial institutions can leverage it to create more prudent financial products and services, such as anti-fraud solutions, scoring solutions and portfolio management solutions. Moreover, financial institutions also need to build their AI and big data technology capabilities based on good interaction design and product management – It is essential for financial institutions to ensure good user experiences in either online services or offline services.

The increasing demands on advanced analytics and real-time output push financial institutions to revisit their existing technology infrastructure. In the future, financial institutions will need to adopt modern APIs to integrate with banks’ or non-bank financial institutions’ systems to orchestrate multiple data sources and platforms that enable cloud services can be conducted with testing, production, or scalable and efficient hybrid infrastructure. Besides, financial institutions will adopt appropriate cybersecurity measures within applications, operating systems, hardware, and networks to secure access and data privacy.

The rapid development of advanced analytics and AI-powered technologies adoption spurs the competition between financial institutions on speed, cost, experience, and intelligent propositions. As a result, financial institutions must engage customers with a highly accurate, personalised, and steadfast process to build top-of-class customer experience and loyalty to remain competitive.