In the boundless world of the internet, eCommerce and Mobile Payments allow merchants to grow at a rate that is no longer restricted by retail floor space. Merchants can now keep their storefronts open 24/7, and serve international customers who are just a click away. However, with this growth comes increased challenges in safeguarding your merchant portfolio against brand and reputational risk, fraudulent transactions, and merchant-based money laundering. Do you really know what your merchants are doing?

That's where our Know-Your-Business solution, One Sentry™, comes in - to help acquirers and payment facilitators reduce risk by staying on top of their merchant's product and service offerings, keep fraud at bay and prevent losing millions to criminals.

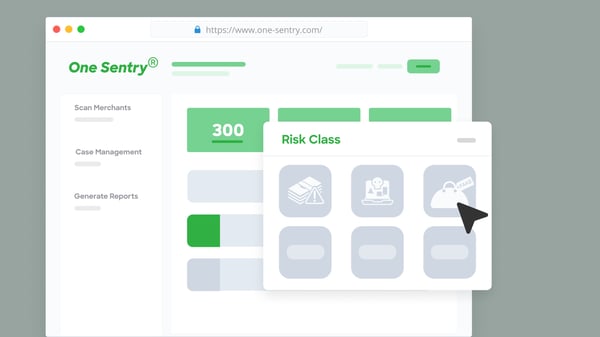

One Sentry is a cloud-based, AI-powered, real-time merchant monitoring solution that actively keeps watch on merchants for high-risk activities. Designed especially for e-merchant acquirers, our platform provides a comprehensive approach to monitor merchants' web, social and transactional behaviour, alerting our customers to risky behavioural traits so that pre-emptive measures can be taken to limit risk exposure.

Using machine learning algorithms for strengthened monitoring oversight, acquirers can focus on growing their merchant portfolio with greater confidence.

Automatically Monitor Merchant Websites for High-Risk Content

One Sentry’s intelligent web heuristic scanner scores merchant websites for traits that are indicative of risky merchant behaviour such as pornography, illegal goods and more. Utilising sophisticated web-crawling technologies paired with intelligent algorithms, One Sentry continuously monitors your merchant portfolio for you.

If any high-risk content or behavioural shifts are flagged, the acquirer is promptly notified so that they can take appropriate action to address the issue. One Sentry’s proprietary detection engine is constantly learning from the data it scans, allowing it to adapt over time leading to improved results.

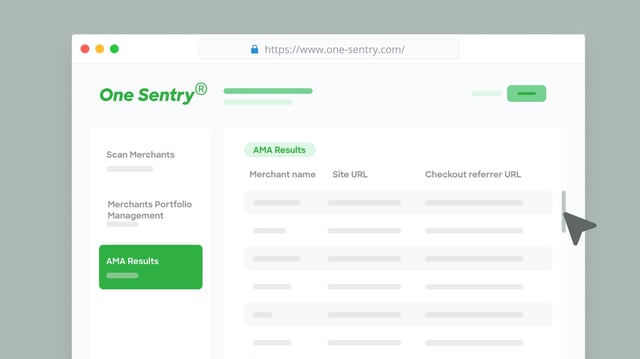

Automatically Flag Transaction Laundering

Transaction laundering occurs when a merchant processes transactions on behalf of an unknown entity, which can be a sign of illegal or fraudulent activity - hiding in plain sight. Proceeds from illegal products like unlicensed pharmaceuticals or child pornography could be processed through approved merchant accounts. This often goes undetected as merchants either create ‘front’ businesses or collude with other businesses, commingling illegal transactions with legal ones.

For example, if a merchant is processing transactions on behalf of an unknown entity, One Sentry may identify this as a potential red flag. The solution will then alert the acquirer, so they can investigate and address the issue. By automatically flagging transactions, One Sentry can help acquirers avoid potential legal and financial risks. If any new merchants that you acquire turn out to be unlawful, you can significantly reduce or prevent the impact of their activities on your business.

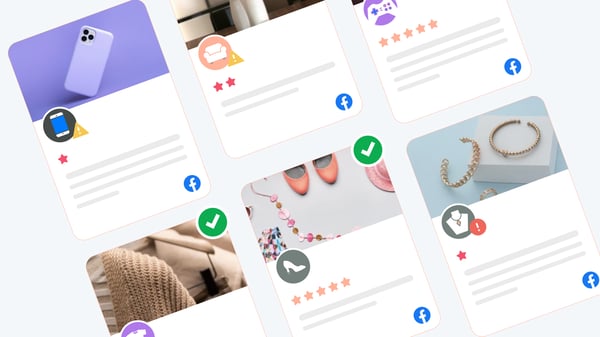

Scan social media to pick up on signs of high risks for charge backs

Chargebacks occur when a customer disputes a transaction and requests a refund from the merchant. This can be a sign of fraud, illegal activity, or other types of risk, which can result in financial losses for acquirer. One Sentry scans for negative customer sentiment posted on your merchants' social media platforms, allowing you to take proactive measures against potential chargeback risks.

Trusted by some of the region's largest banks and payment facilitators, our One Sentry platform is designed to be user-friendly, so our clients can easily access and manage their merchant portfolio, enabling them to quickly identify suspicious behavior.

l l l l l l l l l l ll l l l l l l l l l ll l l l l l l l l l ll l l l l l l l l l ll l l l l l l l l l l

At ADVANCE.AI, we pride ourselves on our ability to work closely with our partners to develop customized solutions that fit their specific needs. We value our relationships with our clients and are committed to providing them with the highest level of service possible.

In today's ever-evolving digital world, protecting your business against merchant risk is essential. Partner with us today, and explore our wider portfolio of Know Your Business solutions, including:

-

Digitisation of your business onboarding via Capture™, which can reduce processing time from days down to minutes.

-

Bring patented deep learning AI to fraud detection via Fraudwall™ to mitigate payments risk.

Experience the peace of mind that comes with having a reliable partner in end to end KYB. Learn more about merchant fraud risk solution at one-sentry.com, or contact us for a demo now.