About the author

Mohammed Fouladi (Mo) is a strategic tech leader with extensive experience in development and implementation of solutions in the areas of cyber security, identity proofing and fraud prevention. With proven skills in solving complex problems, creative thinking and identifying action plans to ensure a successful conclusion, Mo’s expertise is in product innovation, developing strategies for identity proofing, fraud detection and prevention, assisting customers in technology adoption and new feature development based on emerging customer offerings.

Mo has previously shared on Fraud Trends in the Holiday Season.

In today's digital landscape, the importance of identity verification cannot be overstated. For businesses, it serves as a critical defence against unauthorised access, fraudulent activities, and dishonest practices that can lead to significant financial losses and reputational damage.

The need for identity verification is particularly crucial in the gig economy, as exemplified by the food delivery business. For example, account sharing, where multiple workers use the same account to make deliveries, may initially seem harmless but has significant implications for both businesses and end-users. Identity verification is fundamental to the sharing and gig economy, providing security, fraud prevention, legal compliance, and enhanced trust.

Imagine an unverified driver delivering food—the business can't track this unauthorised presence. This raises fundamental questions about accountability, especially in instances involving food safety or personal safety concerns. Who assumes responsibility then? Questions also arise about the original driver's involvement or possible collusion. Did he sell his details to someone else, or was he a victim of cybercrime?

Financial transactions add another layer of complexity. Who rightfully collects the cash, and how can the platform verify that the original driver is not in cahoots with the additional driver for illicit gains?

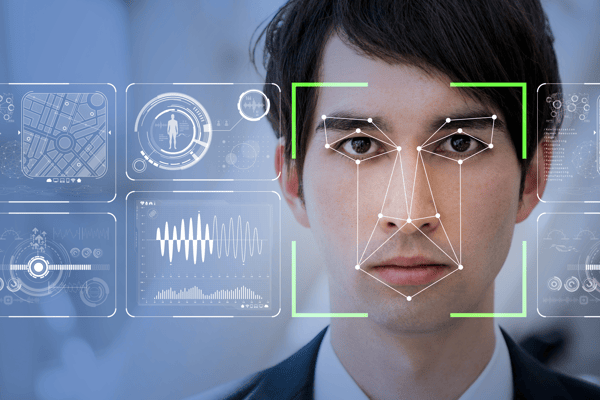

To address the pressing issue of account sharing, many businesses across Asia Pacific are turning to facial recognition with multi-layered verification to verify the identities of their users. This proactive approach not only enhances security, but also fosters a sense of trust and reliability in an ever-evolving gig economy.

Multi-layering with facial recognition as part of identity verification

Facial recognition offers an added layer of security. It verifies an individual’s identity by analysing their distinct facial characteristics, such as the distance between eyes, nose shape, and jawline. These details are captured as a template, with stored templates in a database, commonly used for access control, user authentication, and payment authorisation.

While there has been some controversy around the privacy and ethics of using facial recognition, when securely carried out, it offers an added layer of security to identity verification.

So far, facial recognition has proven critical in the healthcare and financial services industries, both noted as being especially vulnerable to identity fraud.

In banks and financial institutions, facial recognition technology is employed during the customer onboarding and identity verification processes to ensure authenticity. The Bank of Thailand has gone a step further to protect its customers using facial recognition technology. In April 2023, it introduced a policy whereby any local or overseas transaction above 50,000 baht (US$1,440) must utilise facial recognition instead of digital tokens as an additional layer of protection.

And within healthcare, we have seen facial recognition technology being used to prevent people from impersonating others to unlawfully obtain medical treatment or prescription drugs.

Beyond healthcare and financial services, we also see widespread adoption of facial recognition technologies in other industries. In 2022, Malaysia’s Kuala Lumpur International Airport began using facial recognition to verify the identities of passengers before they board their flights. In Singapore, over 4 million Singaporeans and Permanent Residents access government services through a new facial verification feature in its national identity program, SingPass, since 2020.

However, facial recognition is by no means a silver bullet. For instance, facial recognition cannot verify the authenticity of an identification card. It also cannot identify fraudsters that create fake accounts that use synthetic identities at scale.

Besides, given enough time, the best defensive measures today will likely be circumvented by the fraudsters of tomorrow. This is especially true considering the rise of Generative Artificial Intelligence (AI), which can produce various types of content, including text, imagery, audio, and synthetic data. Already, deepfakes are being used to create videos and audio recordings of people—simply by taking the victims' photos or video clips from social media platforms—and fool their relatives and friends into transferring money. Compounding the situation is that, according to one study, facial recognition technologies that employ a specific user-detection method are highly vulnerable to deepfake-based attacks.

The only way to address these shortcomings is to combine facial recognition technology with other identity verification solutions. In fact, having an integrated, multi-layered approach allows businesses to reduce dependency, leverage the strengths of different technologies, and flexibly adapt to the changing threat landscape.

How to deploy a multi-layer approach to identity verification

Document verification

While facial recognition technology is unable to verify the authenticity of an identification card ("ID"), it can be used in conjunction with forgery detection to bolster identity verification processes. For example, ADVANCE.AI ID Forgery Detection uses machine learning models to detect common types of forged or altered ID documents. This process not only allows individuals to complete the Know-Your-Customer (KYC) process remotely through digital channels, they help bolster the security posture of the entire organisation.

Liveness detection

Additionally, facial recognition technology pairs well with liveness detection to potentially overcome the rise of Generative AI-based fraud. ADVANCE.AI recently worked with an Indonesian-based delivery platform to implement a solution that authenticates drivers’ identities—protecting both their customers and its own business. The solution uses a mix of facial recognition and liveness detection, to ensure that the person logging into the account is a live person—and not a 2D print out, video, or AI-generated face—and that they are a match with the registered user.

The growing multitude of tools means that businesses need to truly understand their own needs to build a holistic, multi-layered defence to combat fraud. The key is to find solutions that not only fit your business needs, but they also must work well with one another.

Our team at ADVANCE.AI is continually monitoring and identifying emerging technologies to better safeguard businesses from identity fraud, or other related risks. In our product development, we endeavour to introduce solutions that can be executed in meaningful ways to help organisations combat bad actors.

Having a multi-solution approach to identity verification and security can offer several important benefits for organisations, particularly in terms of enhancing overall security, flexibility, and resilience.

Explore ADVANCE.AI’s suite of AI-powered facial recognition and document verification solutions here.